In days of yore, many Americans typically relied on a defined benefit plan (commonly referred to as simply a pension) as the anchor of their retirement income. A quick refresher, defined benefit plans promise a specified monthly benefit at retirement.

Defined Benefit Plans

The defined benefit plan may state this promised benefit as an exact dollar amount, such as $1,000 per month, once the employee has met the requirement(s) (e.g. length of employment) at the time of retirement. More commonly however, retirement benefits are calculated through a plan formula that considers such factors as salary and years of service.

Combined with Social Security benefits and personal savings, these three elements were often referred to as the “three legs” of the retirement stool. Let there be no doubt, that model is long gone, dead, and it is not coming back.

Private employers, and many public sector employers, have moved – or are moving to – defined contribution plans. These plans, such as a 401(k)s, do not guarantee a specific amount of benefits at retirement. In these plans the employee – often with matching contributions from the employer – contributes to the employee’s individual account under the plan. The value of the account at the time of retirement will be based on the performance of the underlying investments over the course of the period contributions were made.

As noted by Towers Watson in an October 2013 study, the number of Fortune 100 companies offering new salaried employees only a defined contribution plan continued to rise, as it has for many years. Today, less than a third of these companies offer any defined benefit plan to newly hired salaried workers, and only 11 still offer a traditional defined benefit plan to new hires. Unfortunately, this phenomenon is not limited to Fortune 100, or even Fortune 500, companies. It is the future for the majority of employers.

Make no mistake, defined benefit plans are undergoing significant fundamental changes as previously discussed here, here, and here. Adding to the difficulty is the fact than many individuals no longer work for one employer over the course of their careers. In this new economy, within this present business environment, you can no longer expect to work for a single employer for 10+ years and you cannot expect that any of your employers will offer a defined benefit plan.

Social Security Benefits

Combined with the fact that the second leg of the retirement stool – your Social Security pension – is likely to be negatively impacted in the future, particularly for younger workers, and you are left with one leg of the stool…your personal savings. You, my friend, are on your own. The best way to succeed in this new environment? Develop multiple streams of income during your working years and ensure your plan will generate multiple streams of income in retirement.

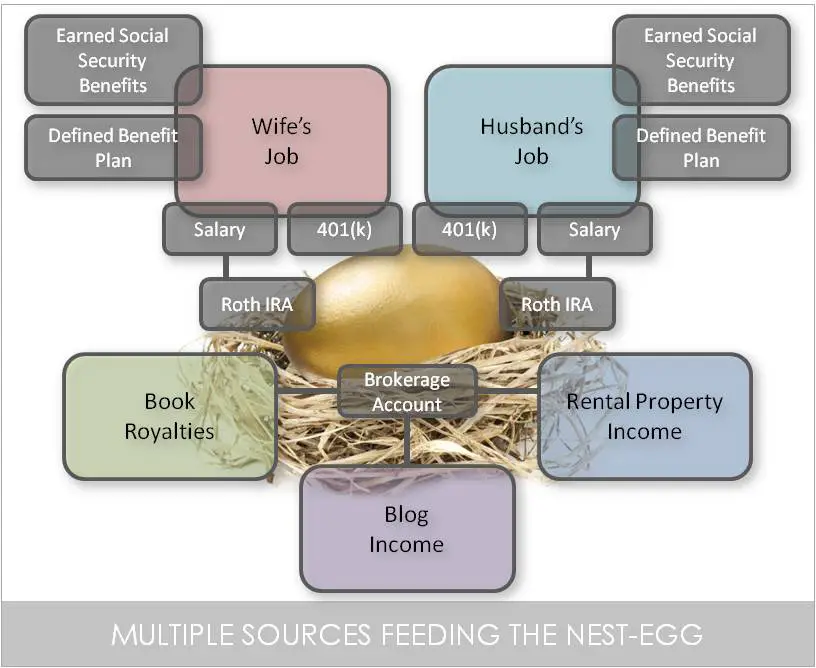

Using my family as an example, let’s look at multiple streams of income during the working years first. While the primary sources of income for me and the wife is our 8-5 day jobs, we also own a rental property, I run this blog – which typically generates a few hundred dollars a month – and I have published a couple of books which generate a little bit of revenue each month in the form of royalty payments.

Passive and Portfolio Income

Turning to multiple streams of income in retirement, let’s look at the two sources of income, passive and portfolio. Regarding passive income, if you are a frequent reader of this blog, you know that I retired from active duty (U.S. Army) which provides one source of passive income. That will be combined with the pensions from our current jobs (we are fortunate in that we both have defined benefit plans with our current employers), Social Security pensions, rental income if we keep the rental property that long, and royalties from my current books … and others I might write. For portfolio income, we are looking at our Roth IRAs, our Thrift Savings Plans (equivalent to 401(k) plans), and a brokerage account.

All combined, my plan is to have 10-12 different income streams in retirement with the expectation that one or more will be negatively impacted over time by forces beyond my control. With regards to retirement planning, more is definitely better.

Final Thoughts

And you, SavvyReader? Are you developing multiple streams of income during your earnings years to feed your nest-egg? Are you developing multiple sources from which to draw in retirement?