You may have heard, or read, something about the AOL brouhaha recently. If you haven’t, here is a quick summary for you.

In a CNBC appearance recently, Chief Executive Officer (CEO) Tim Armstrong announced that effective this year, 2014, AOL would make a change in the way it distributes 401(k) matching contributions to employees. Instead of providing matching contributions with every paycheck, which is traditionally the norm, AOL would match employee 401(k) contributions at the end of the year. That means employees who leave the company before Dec. 31 would not get the year’s company match at all.

The rationale behind the move? The Affordable Care Act (ACA), derisively known as Obamacare, had resulted in an additional $7.1 million expense for the company. Many people found the timing of the announcement odd as AOL had recently released better-than expected earnings and revenues.

The howls of protest started almost immediately. Primarily because Mr. Cook cited two distressed pregnancies (bad form!) costing $1 million each – touching on the health care expense – but also because people understand that the move essentially saves money for the company…at the expense of rank and file employees. By Saturday, the CEO had apologized and reversed course. AOL decided to maintain their policy of matching contributions with every paycheck.

And that second part is what I would like to discuss. Not the political aspects of the story. As a business major – MBA with a specialization in management – I understand, and believe I could make a business case (without referencing distressed pregnancies), why switching to lump-sum year end 401(k) matching is good for the company.

However, this is personal finance blog – with a focus on retirement planning – and my goal is to educate and inform readers, the individual, about all of the things that can, and will likely, impact managing their portfolio and achieve financial freedom en-route to retirement.

One important thing to remember is that even though AOL reversed itself, the practice is becoming more widespread. With that said, let’s imagine a fictional employee (Bob) at a company that uses lump-sum year end 401(k) matching and see how such a policy would impact his retirement portfolio.

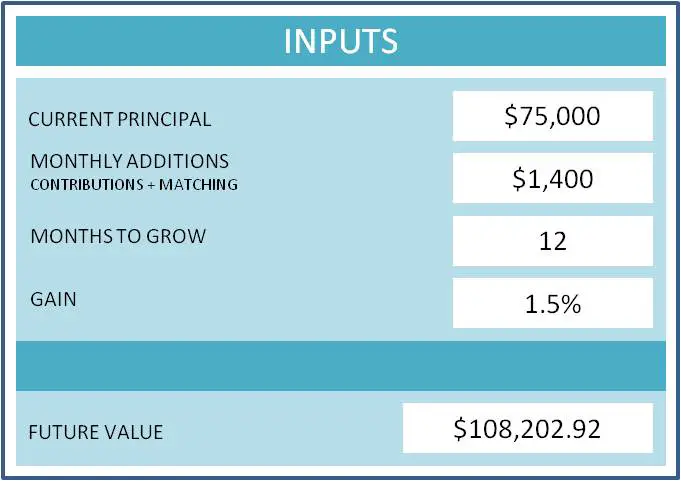

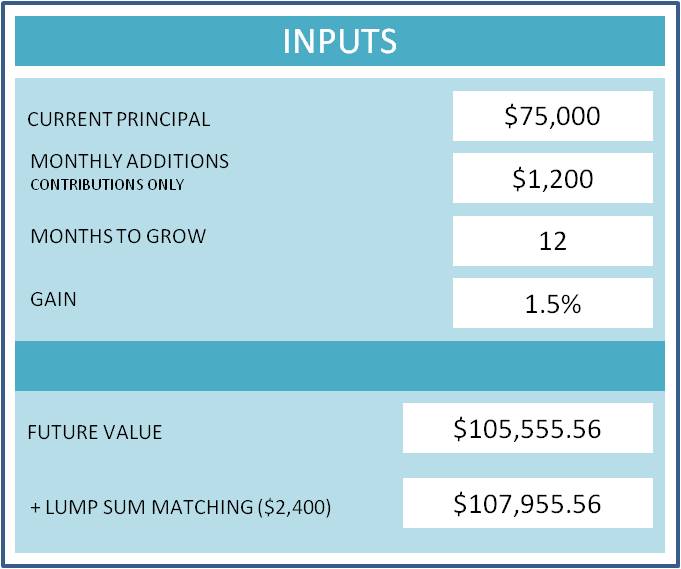

First, let’s get some numbers together. Let’s assume Bob starts the year with $75,000 in his 401(k) account. He contributes $600 twice a month ($1,200) and his company matches $100 every paycheck ($200/month). And let’s assume the market gains an average of 1.5% each month. Plug all the numbers into our magic compound interest calculator…

Monthly Matching

Lump-Sum Year End Matching

While the $247.36 difference may not seem significant, at least to some, that is $247.36 that will never be working for Bob. Not during the current year, the following year, the year after that….

Moreover, the money “lost” gets more significant every year, which means every year the amount of money not working for Bob increases. If you would like a refresher on the significant power of compound interest, you can look here and here.

What say you SavvyReader? What do you think of lump-sum year end 401(k) matching?