With regards to personal finance and your fiscal health, establishing a budget is a good place to start. Before moving forward, I should note that I have recently started using the term ‘spending plan’ vice budget and I sometimes use them interchangeably as they refer to the same action.

However, for many, ‘budget’ has many negative connotations, representing constraints and speaks to what you will not, or cannot, do. Conversely, a spending plan, is viewed more favorably, in a more positive light, as it speaks to what your values and goals are; and how money should flow in and out of the home.

A spending plan is an effective tool for controlling debt and serves as a financial guide. It lets you know if you are heading in the right direction and are on track to reach financial goals such as buying a home, sending a child to college, or preparing for retirement. In addition to being an effective financial guide, a spending plan allows you to measure your progress on a regular basis and implement changes as necessary.

The first step in establishing a spending plan is to track your expenses over a given time period; three to four months at a minimum. Doing so will reveal two critical pieces of information: your total expenses relative to your income and your current income allocation. With that information in hand, you are ready to gain control of your financial life.

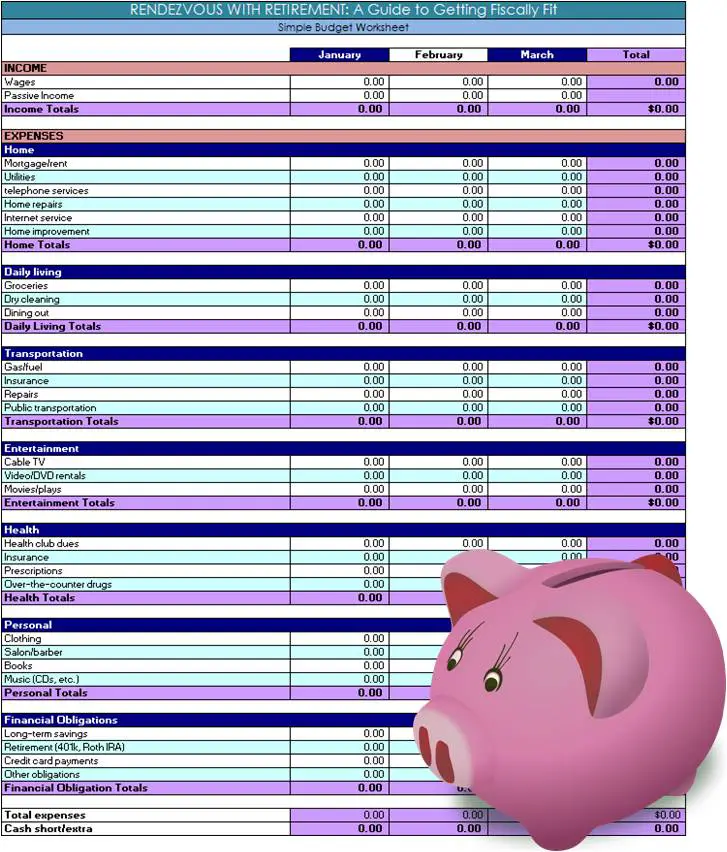

The RWR Spending Planner – part of the RWR Simple Retirement Workbook – is available as a free download. Ideally, your income will exceed your expenses. If not, you should consider ways to generate more income and/or determine how you can reduce expenses. Once you have achieved a positive monthly status, you can look more closely at your current allocation.

Are you allocating enough money to areas such as savings or retirement accounts, and other vehicles that will help you reach your financial goals? If not, your spending plan will help identify the areas (e.g. entertainment, clothing, transportation) where you might be able to reduce expenses, making a shift to more desirable areas.

Integration of Strengths [TramueL]

As you might imagine, managing your spending plan is not a once and done proposition; it is a very dynamic process that will change over time as your income changes, your debt is reduced, and numerous other factors. Therefore, you must be prepared to monitor your spending plan, and adjust as necessary, on a regular basis, continually looking for ways to reduce expenses and ensure that you are on track to reach your financial goals.

What tool(s) do you use to manage your spending plan?