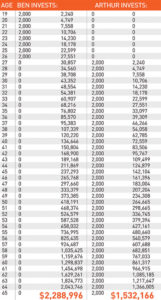

The Ben and Arthur chart is an illustration by personal finance guru, Dave Ramsey. It purportedly shows how important it is to invest early.

The Ben and Arthur Chart Explained

The Ben and Arthur chart illustrates how investing early can be more powerful than putting in more money.

Here’s the story behind the chart:

Ben and Arthur are close friends. Ben starts investing at the age of 19. For 8 years he invests $2000 annually in investments that earn him 12% in compound interest every year. By the age of 26, Ben stops placing any more funds into his investments. So in total, he has invested $16,000.

Arthur starts investing at the age of 27. He puts $2000 each year in his investment funds that earn him an annual interest of 12%. However, unlike Ben, Arthur continues to invest even after he has reached retirement age (60+ years).

In total, Arthur invests $78,000 over a period of 38 years, while Ben invests a total of $16,000 over a period of 8 years.

Now, who do you think ended up with a larger portfolio by the time they were each 65?

Here’s the shocking reveal:

When Ben and Arthur turn 65, Ben has accumulated $2,288,996, while Arthur has accumulated a total of $1,532,166. The reason why Ben has more money than Arthur is because he started investing earlier than his friend.

Because interest compounds, Ben begins to earn interest on his investments a lot earlier than Arthur. By the time Arthur starts investing, Ben’s interest already outstrips the yearly contributions Arthur can make.

How you can apply the principles of Ben and Arthur to your investing

The fundamental principles of Ben and Arthur are:

- Start investing early

- Invest some amount of money each year at a favorable interest rate

The earlier you start investing, the sooner you start earning interest. The idea is to increase your money through compound interest.

To better explain how the Ben and Arthur concept works here is an example:

If you invest $1,000 and earn an interest rate of 10%, this means that your interest after 1 year will be $100. So if you add that to the original amount you invested, in this case the $1000, your total will be $1100.

If you take the $1100 and invest at the same interest rate, your interest at the end of the following year will be $110. When you add that to the $1100 you invested, your total will come to $1200.

So the amount of money you earn from the interest continues to grow. This is what is referred as compounding. When you reinvest the amount you earn each year from your investments, your total earnings continue to increase.

The formula for calculating compound interest is as follows:

A = P (1 + rn) nt

P = this is the principle amount i.e. the original amount you invest.

A = this is the future value of the principle amount.

r = this is the interest rate.

n = n is the number of times you receive interest in a given year.

t = this is the time in years the principle amount is invested for.

Example

Brian wants to have a sizeable amount of money in 30 years for his retirement. He decides to invest $100,000 in an investment that is paying 10% interest rate that is compounded monthly, if he decides to invest this money for 30 years, by the end of that period, how much will he have?

P = $100,000

r = 10%

n = 12 months

t = 30 years

If you apply the formula, you’ll see that at the end of the 30-year period, Brian would have earned approximately $1,983,739.94. The total interest he will have earned alone is about $1,883,739.94.

As you can see, in the 30 years, Brian will have earned $1,983,739.94. Compounding interest can grow your investment funds exponentially.

Criticisms of the Ben and Arthur illustration

While some financial experts agree with the Ben and Arthur illustrations, some do not. According to some investment experts, the Ben and Arthur illustrations are utterly rubbish.

Here’s why:

While it is true compound interest can boost your returns, in the case of Ben and Arthur. The assumption is that you can earn a 12% interest each year, for several years whether the market is good or bad.

This is not true. Compound interest can only earn you good returns, if the interest rate does not fluctuate throughout the duration of the investment period. However, if the market prices fall, this would affect the interest rate, and subsequently the total returns.

Today, it’s nearly impossible to earn a 12% interest yearly. For example, the S&P 500 in 2017 had an average yearly return of about 9%. In the last two decades S&P 500 has averaged about 7% overall.

Given the numbers, if you are planning for retirement, it is better to stick with a realistic number like 7% or 8%. With a projection of 7% or 8% average return rate, you are able to control your savings rate.

So it is better to keep your focus not on the return estimate but on the savings rate. It’s great if you can average a return rate of 7% or 8% over a long period. However, there are times when you can get an average return rate of 19% and there are times you can get a return rate of -14%.

Between 1995 and 1998, S&P 500 overall average return rate was 28%. So those who invested within the 5-year period tripled their money. But in the subsequent 3 years, the market had toppled and those who had tripled their investment found that their investment had reduced by about -14%.

The other observations was that the Ben and Arthur illustrations work on the assumption that what you can purchase with $2000 at the age of 19, your age-mate can purchase the same thing 10 years later.

This is untrue. If everyone earns a fixed amount of interest on their investments consistently over several years. This means that everyone will have more cash, but will not be richer or wealthier. If the vast majority of people have more cash, prices will go up.

So what you could purchase with $2000, 8 or 10 years ago, cannot have the same value today. Either this value would have reduced or increased significantly, depending on how well or not the market has been doing over the years.

Final thoughts

The Ben and Arthur story teaches a valuable lesson of the benefit of investing early. But it is important to look at things from a realistic point of view before investing.

Interest rates for example fluctuate when market prices fall and rise. So whatever interest rate you earn on an investment in a given year, may not be the same rate you earn in a different year.

So even though the Ben and Arthur illustrations encourage young people to start saving money early, it is misleading. It is therefore, important that you do your homework before making any kind of long-term investment for your retirement.