Previously I discussed the 4% Rule, a popular and well-known method of withdrawing money from retirement accounts. I noted then that the rule – developed by William Bengen – posits that if a retiree takes out 4% of their nest-egg the first year in retirement, and then adjusts that rate to account for inflation in each subsequent year (e.g. if inflation rises 1% during the first year of retirement, 5% would be taken out during the second year in retirement), they will not run out of money for at least three decades. You can read more about the rule in the Develop Your Withdrawal Plan post.

More recently I discussed the Sequence of Returns Risk. This risk notes that two retirees with identical wealth can have drastically different financial outcomes, depending on when they start retirement. A retiree starting out at the bottom of a bear market will have better investing success in retirement than another starting out at a market peak, even if the long-term averages are the same.

This phenomenon can be viewed and understood in a couple of different ways. An article by John Hancock illustrates different potential outcomes when two retirees retire ten years apart when all else (e.g. portfolio value, rate of return, etc.) is equal. A second article by BlueCreek Investment Partners illustrates a possibility when all factors are the same, except in this case the rates of return are identical, just flipped over a 15-year period. At the end of that blog post I noted that individuals needed a solid withdrawal plan and should be aware of Sequence of Returns Risk; and in a response to a comment from long time reader Brian, I mentioned the RMD Withdrawal Strategy as one that is being discussed more.

Here is the rule summarized, straight from the IRS RMD webpage: You cannot keep retirement funds in your account indefinitely. You generally have to start taking withdrawals from your IRA or retirement plan account when you reach age 70½. Roth IRAs do not require withdrawals until after the death of the owner. Your required minimum distribution is the minimum amount you must withdraw from your account each year.

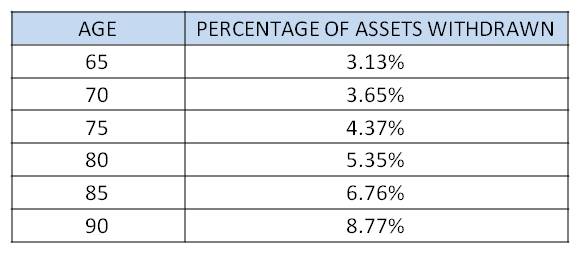

In place of a 4% based withdrawal rate, some have simply taken to using the withdrawal rates outlined by the RMD even before they reach age 70½. I don’t want to get too far down in the weeds on RMD calculations, as this post is not about those calculations, but using the percentages derived from them as a guide. Specifics about RMD can be researched easily on the IRS site. However, I will note that the percentages in the RMD tables equal 100 divided by the life expectancy of a couple in which one spouse is 10 years younger. As an example, the life expectancy of couple aged 70 and 60 is 27.4 years. Therefore, the RMD for a 70-year old is 100/27.4 or 3.65 percent. A recent book I read – a recent SavvyRecommendation – Falling Short: The Coming Retirement Crisis and What to Do About It, offered the following table:

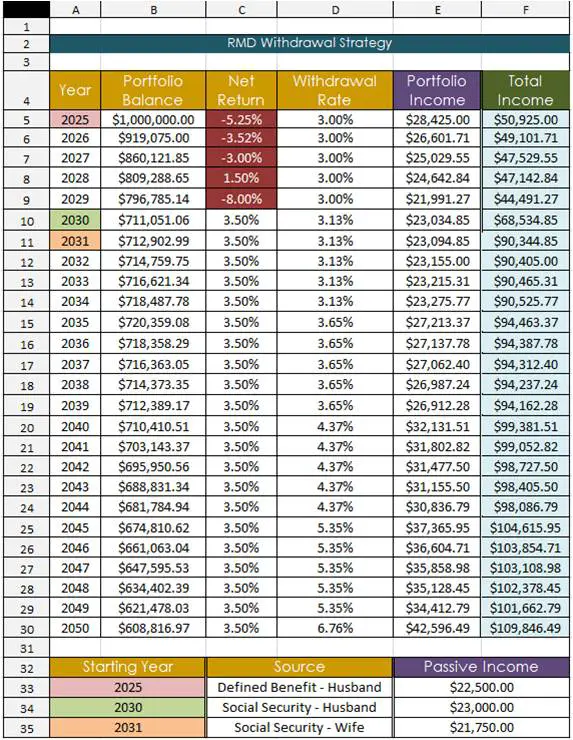

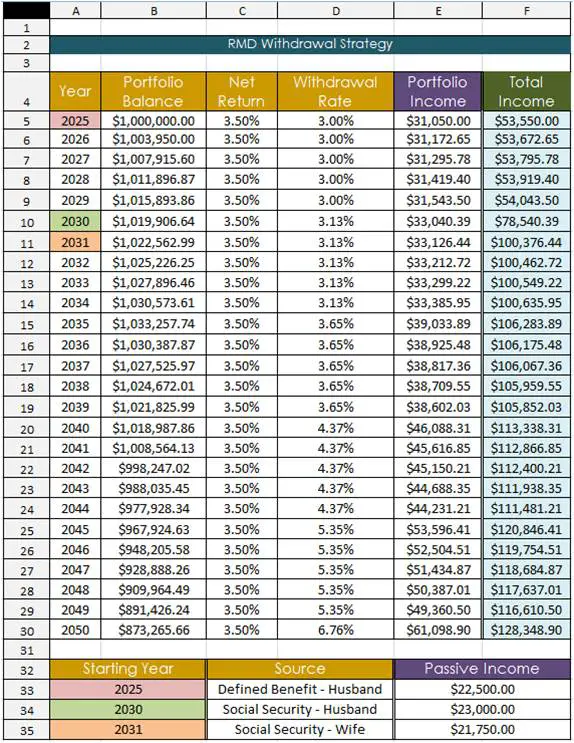

Using it as a guide, I plugged in 3.00% (see table below) for the years 2025 – 2029 when the husband, who turns 60 in 2025, would be aged 60 – 64. Here are the other factors that would play into establishing a retirement income withdrawal plan for this example couple:

- They enter retirement with a $1,000,000 portfolio from which they will draw portfolio income

- Let’s assume their Net Return (investment gains minus fees – cell C4) is 3.5% each year

- The husband will a receive pension (defined benefit) from his current job [cell 33 shows the projected income]

- The couple determines they will wait until 65 – 2030 [cell E34 – projected income] for the husband and 2031 [cell E35 – projected income] for the wife to draw Social Security benefits

- Note this scenario does not account for taxes

The table below illustrates their total retirement income (cell F4, the combination of portfolio and passive income) each year starting with $1,000,000 in their portfolio (i.e. 401(k)s, IRAs, savings, brokerage accounts, etc.) after the difference between gains and fees are accounted for; and the different sources of passive income are added each respective year. Therefore, 2025 – 2029 is portfolio income + husband’s pension; 2030 is portfolio income + husband’s pension + husband’s Social Security; and 2031 and beyond is portfolio income + husband’s pension + husband’s Social Security + wife’s Social Security.

So what happens if we change some of the early returns, make them lower or even negative during the first five years? You can see the impact below. While this couple would be alright, they will still have $608,816.97 in 2050, you can see that they would have less in 2050 than they would in the first scenario and – all other factors staying the same – their retirement income would be less each year. As I preach in my book Rendezvous With Retirement: A Guide to Getting Fiscally Fit and as I have noted on this blog numerous times, you have to know and track your numbers … not only during the accumulation phase but during the withdrawal phase also. By creating a spreadsheet such as the one illustrated here, you can see what impact changes to the various factors will have on your financial well-being.