Along with politics, religion, and race relations, money is one of those things most people do not like to talk about. Recently I posted the value of my portfolio after a brief internal debate. One reason I decided to post the value was because of legitimacy. By that I was referring to the idea an individual that is writing about personal finance and retirement planning should be able to offer readers some insight into their own financial lives; some sort of ‘proof’ so to speak.

A quick side note, I like to look strictly at portfolio value (aka financial wealth) – which excludes things like home and car values – that are traditionally included in net worth, which is determined by subtracting the total dollar amount of all liabilities from the total value of all assets. My rationale? When you are ready to retire, who cares how much Kelly Blue Book believes your car is worth or how much Zillow believes your house is worth? Those numbers are largely irrelevant.

What is most important in retirement is how much passive and portfolio income you will be receiving on a monthly basis. In RENDEZVOUS WITH RETIREMENT: A Guide to Getting Fiscally Fit I note that a good retirement plan starts with understanding how much you need on an annual basis to live the lifestyle you desire in retirement, and then constructing a plan to ensure passive and portfolio – sans earned income – can meet those needs. Perhaps portfolio value vs. net worth is a discussion worth having in a later post. Anyway, with that said, is there any value in knowing how your net worth stacks up against your friends, neighbors, or co-workers? I would suggest there is.

While you do not want to get trapped in the game of keeping up with the Joneses (and likely accruing unsustainabledebt) or basing your self-worth on a comparison of your net worth, knowing how others are doing financially – particularly within the context of similar income, age, etc. – can offer some insight into how you are doing. If others in your age group are making a similar income, yet have a net worth 3x yours, you might want to at least give some consideration to re-evaluating your investment plans. Conversely, if your net worth is 3x that of others that are demographically similar, you can take some comfort in the knowledge that you are probably doing a lot of things right already.

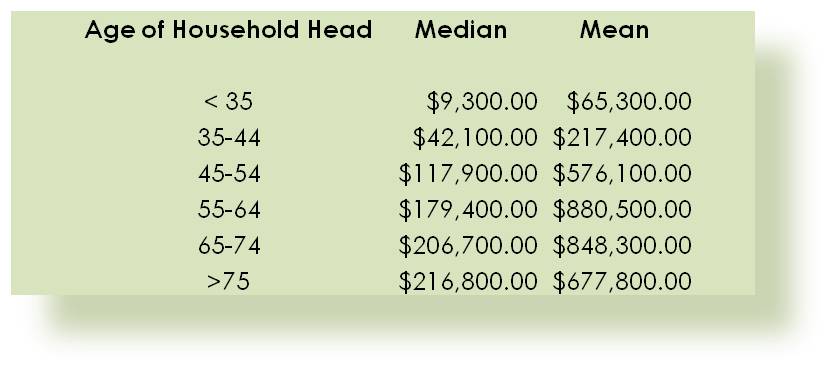

Illustrated in a table, this is how American’s net worth looks. The median (middle) is the more useful number as the mean (average) is skewed higher by the insanely rich.

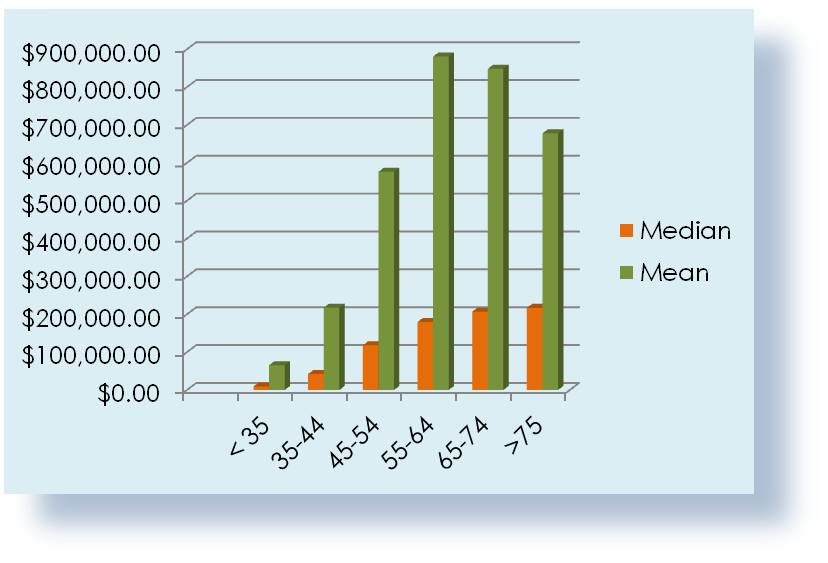

And illustrated in a chart…

Source: Table 4 [Family net worth, by selected characteristics of families, 2001–10 surveys] of the Federal Reserve Bulletin, Volume 98, Number 2, dated June 2012.

So SavvyReader, how does your household stack up? Have you taken the time to utilize a Retirement Calculator to determine how much income your nest egg can generate in retirement?