My story doesn’t quite begin the way many fairy tales do. It begins with, “Damn!” Marcus swore under his breath as he blew into his cupped hands, trying to warm them and fend off the cold October air.

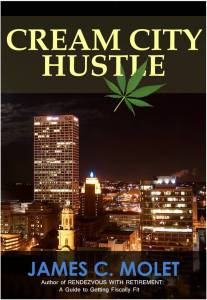

For the last six months or so I have been working on my first novel, a personal finance thriller entitled Cream City Hustle. Most of the writing was completed about three weeks ago and recently, the book’s Editor, Brian D. Tramuel, finished his work. Once Brian was finished, the draft was finalized, an ISBN assigned, the book published and subsequently uploaded to Amazon.

Over the course of the last week, the book has been available for pre-order. As of this morning the Kindle Edition is now available for download. Don’t have a Kindle? That isn’t a problem. Any device (e.g. iPad, iPhone, Windows phone, Android devices, desktops, laptops, etc.) that supports a Kindle app can be used.

The idea behind the book was simple. I wanted to do something a little different from my work here on this blog. I wanted to communicate personal finance concepts and ideas within the framework of a fictional thriller. While there are financial thrillers out there, it is a fairly small genre. I’m not even certain that a would be sub-genre, personal finance thrillers, has any entrants. If so, it has to be a fairly small number. The execution was more difficult. I wanted to avoid simply ‘plugging’ personal finance concepts and practices into a story. I wanted to share them is such a way that they fit naturally into the story and are easily absorbed by the reader as the tale unfolds.

The story’s protagonist, 20-year-old Marcus, faces the same challenges many other Millennials are now confronting with respect to money management: building and maintaining an emergency fund, controlling debt and saving for retirement. Two years out of high school, Marcus yearns to go to college, recognizing that despite the costs, a college degree still generally provides the best path to the middle class and beyond. However, he has no desire to take on the onerous debt often required to earn a degree in 21st century America. Moreover, his minimum wage job at a fast food restaurant ensures he will never be able to live a middle class life and save for college. His answer? Work part-time in a criminal activity to build and maintain an emergency fund, save money for college and establish a foundation – via a Roth IRA – for retirement. Unfortunately, this activity brings him into contact with the story’s antagonist, Caine; suspense, tension and violence ensue.

The three personal finance practices alluded to previously are weaved into the story:

Emergency Funds: This is a cash account that is used only in the event of an emergency, to fill critical financial gaps, or meet unexpected expenses. It is immediate access to cash that allows individuals to take care of unforeseen circumstances without impacting the money they have committed to saving and investing. Individuals that fail to build and maintain such a fund often find themselves relying on credit cards to overcome emergencies and subsequently incur more debt.

Emergency Funds: This is a cash account that is used only in the event of an emergency, to fill critical financial gaps, or meet unexpected expenses. It is immediate access to cash that allows individuals to take care of unforeseen circumstances without impacting the money they have committed to saving and investing. Individuals that fail to build and maintain such a fund often find themselves relying on credit cards to overcome emergencies and subsequently incur more debt.

Debt: Particularly student loan debt is troublesome for Millennials. A recent TransUnion study found that a decade ago, student loans accounted for only 12.9% of the total debt load carried by people ages 20 to 29. It now stands at 36.8%. Moreover, the average student loan balance for those with loans jumped to $29,575 from only $17,442 in 2005. Student loan and credit card debt is killing Millennials. If a young person is constantly focused on debt, they are not in a position to save and invest for financial goals such as buying a home or saving for retirement.

Retirement Savings: For those that fail to recognize, and use, the power of time and compound interest, or are unable to take advantage of the phenomenon because of existing requirements to service debt, time soon becomes the enemy. Too often those that have failed to invest sufficiently during their 30s and 40s assume that they will simply work longer; work past the traditional retirement age. Numerous recent studies have shown that a majority of workers are now planning to work past the age of 65, many are planning to work past age 70 and some have no plans to ever retire. However, the decision to work may not be up to the individual. Changes in the economic environment or health related issues often force people out of the workforce earlier than desired. Therefore, it is absolutely essential that people develop and start funding a retirement plan as soon as possible, ideally in their 20s.

I hope you will give the book a look. Did we just have a Dr. Seuss moment? I believe so. Anyway, I hope you will take the time to read the book and let me know, through providing a review at Amazon or dropping by this blog, if I was able to pull off weaving personal finance ideas and concepts into the framework of a thriller, in an engaging way.

I look forward to all feedback as I work my way through my second novel, Sin City Greed, think American Greed (the CNBC show) meets Ocean’s Eleven.

The hustle is on! Cream City Hustle is now available at Amazon.