Anyone that has read my book, RENDEZVOUS WITH RETIREMENT: A Guide to Getting Fiscally Fit, or has been reading this blog for awhile knows that I have reservations about utilizing financial advisors (planners). In fact, I believe most people are better off educating themselves with respect to personal finance and developing/managing their own plan. However, I do recognize that there may be specific occasions when it makes sense to seek outside counsel. In my book I noted:

There will likely come a time when finding a good planner is appropriate. As an example, a friend of mine recently started consulting with a professional advisor as he and his wife are within a few years of retiring should they choose. While he is comfortable with the decisions he has made at this point and given significant thought to his withdrawal plan (a topic covered in great detail in Chapter 6), he would like to get a second opinion to ensure he has not overlooked anything or is not considering pertinent information. Similarly, I plan to do the same thing when I get to within four or five years of retiring.

While I am not within four or five years of retiring, I did decide recently that I had a very specific desire and it might not be a bad idea to have an objective second opinion. First, before I discuss that desire, I should note that when utilizing the services of a financial advisor, I always suggest that people look for a fee-only, vice a fee-based, advisor. The difference? Fee-only advisors have no inherent conflicts of interest, they don’t accept fees or compensation based on product sales, and they generally provide more comprehensive advice. Many also carry professional designations which hold them to strict codes of professional and ethical conduct. Conversely, fee-based advisers can charge a one-time or ongoing fee, depending on the types of services they provide. The fees may be hourly, flat or based upon a percentage of assets under management. Also, fee-based advisers may charge both fees and commissions based on the products they sell. Most fee-based advisers hold licenses that allow them to sell investments or insurance products for a commission.

While I am not within four or five years of retiring, I did decide recently that I had a very specific desire and it might not be a bad idea to have an objective second opinion. First, before I discuss that desire, I should note that when utilizing the services of a financial advisor, I always suggest that people look for a fee-only, vice a fee-based, advisor. The difference? Fee-only advisors have no inherent conflicts of interest, they don’t accept fees or compensation based on product sales, and they generally provide more comprehensive advice. Many also carry professional designations which hold them to strict codes of professional and ethical conduct. Conversely, fee-based advisers can charge a one-time or ongoing fee, depending on the types of services they provide. The fees may be hourly, flat or based upon a percentage of assets under management. Also, fee-based advisers may charge both fees and commissions based on the products they sell. Most fee-based advisers hold licenses that allow them to sell investments or insurance products for a commission.

My desire? Get a second opinion/thoughts on a withdrawal (decumulation) plan, a topic I have discussed in the book and here and here on the blog. I would like to present all the relevant information – current ages for me and the wife, number of years until we planned to retire, our desired annual retirement income, current balances of retirement and investment accounts, projected balances of retirement and investment accounts at the time of retirement, projections for Social Security benefits and projections of pensions (we will be receiving three, one of which we are already receiving) and develop a plan based on those factors, taking into account the different tax implications of various accounts, inflation, different, the RMD, etc. – to a financial professional and compare the plan/recommendation they come up with to my own.

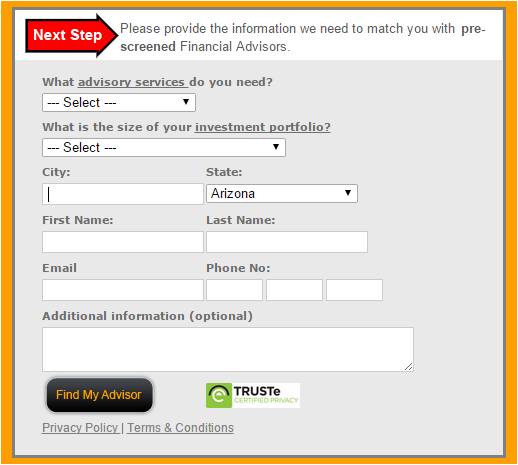

Note that this need is very specific need, does not involve the purchase of a product and nor does it require an ongoing relationship. Clearly my needs would be best served by a fee-only advisor … easier said than done, my friends. I first thought I would try WiserAdvisor.com to locate such an individual. WiserAdvisor is one of those sites that takes some basic information (e.g. name, email address) asks a question or two to determine what it is you’re looking for and pairs you with a provider in their network. Below is a screenshot of the Information page. This is the page that came up after I input my zip code to find a local advisor. In the Additional Information block (Optional), I input the following information: I am seeking a fee-only advisor to assist me with the development a retirement withdrawal plan. Seems pretty straight-forward to me; a fee-only advisor in my area, Southeastern Arizona, that has the ability to develop a withdrawal plan based on provided information.

The next day, following verification of my email address, I received calls from two advisors. The first was from Beverly Hills … the one in California, about 561.7 miles from my home. No problem I thought, while I was pretty certain the indication on the WiserAdvisor site was that it would be a local advisor, someone I could sit and talk with, I went with it, the guy seemed nice enough. However, it was pretty clear early on that he was interested in managing my portfolio and establishing an ongoing relationship. We never got around to the fee structure.

The second advisor to contact me was from Arizona, Tucson to be exact, a little over an hour from my home. Again, nice guy, but it was clear he was not really into a fee-only type service, whereby I give him the information, he applies his knowledge and expertise, and he delivers a report/recommendation for a one time cost that is reflective of the time he spent developing the report. However, he did suggest he could do it and in fact, he followed up our phone conversation with the email below about an hour later …

Hi James,

It was nice speaking with you today. I am happy to build a retirement plan and review everything we discussed earlier. I typically include the plan for clients that hire us to manage their assets. If you would just like to have us run the plan for you and analyze your situation we charge $750 for the plan with no strings attached. Of course, if you did decide to work with us we would waive the fee.

Please let me know what you decide.

Best,

Mark xxxxx, CFP®

Yep, you saw that right. He would be willing to develop such a retirement withdrawal plan for $750. Now, I’m not a cheapskate and I am absolutely willing to pay a professional for their time. Even at $75/hour, do I believe it would take 10 hours to develop such a plan? No. This is 2015 and I’m sure he has some pretty sophisticated software. If I’m providing him with all the relevant information and he is simply plugging it into a program that runs different scenarios, applying some of his own knowledge gained from years of experience and training, and then printing them out, I’m having a hard time seeing $750 as a reasonable price.

Giving up on WiserAdvisor, I went back to the good ol’ Internet and looked for some local advisors on my own. I live in a relatively small town (population ~ 50,000) and I was only able to identify three prospects. Below is the request I sent to each either via email or the comment/question form on their website …

Sir or Ma’am,

Are you a fee-only or fee-based advisor?

If the former, I would be interested in learning about your fee schedule, and perhaps, scheduling an appointment.

James Molet

520.xxx.xxxx

As of this writing, I have had contact with two of the three offices. The first advisor I reached out to noted, via an out of office reply, that she would be out of the office for a few more days. However, the auto-reply provided contact information for her assistants. Following a couple email exchanges, I had a phone conversation with one of them. A nice enough young lady, however, my sense was that she is a financial novice, perhaps an intern with only basic knowledge of financial planning. Even after I reiterated what the original email noted, I was looking for a fee-only advisor, I was pretty satisfied with managing my own portfolio and I was looking for one very specific service, one time, she continually tried to stress that her boss would likely be able to offer guidance with respect to portfolio management. Regardless of my assurances that I thought I was in good control of my portfolio and I simply wanted a second opinion on a withdrawal plan based on the information I was willing to provide, she continually came back to portfolio management. Ultimately I indicated it would be okay for her boss to contact me when she was back in the office and we could determine if she was able, and willing, to provide the one service I sought.

Contact with the second advisor played out similarly to the first. Just as with the first, the primary advisor was out of town and would not be available for a few more days. However, there were a couple distinct differences. First, the person I spoke with was clearly more knowledgeable and after a few minutes, she indicated that it was clear that I knew what I was talking about and had a firmer grasp on personal finance and financial planning than most. Even with that however, like the first, she continually tried to steer the conversation to an ongoing relationship and portfolio management, in spite of what was stated in my first contact with her and me clearly articulating what I was seeking during the course of our phone conversation. Ultimately she confided that their office is fee-based only and they would not be able to help with what I was looking for. I guess she didn’t value my 10 minutes which were wasted.

For now I will wait and see if the third local advisor ever contacts me and I will speak to the first advisor when she reaches out to me, but I doubt if anything will come of it. While I understand the model the two local advisors are working within and their preference for an ongoing relationship vice a one time service, they played it all wrong. It seems as if it never crossed their minds that providing the one time, fee-only, service that was being requested might in fact lead to an ongoing relationship and future services. Perhaps I would have been pleasantly surprised by the results contained within their withdrawal plan/recommendation and the professional way they developed and delivered it; and I would be amenable to considering some type of ongoing relationship. Or even if I still felt their services were not for me, I might be comfortable recommending them to a friend or coworker who was looking for such services.

As it stands, I’m less impressed now with financial advisors, particularly with the fee-based type, than I was before.