Report: Most Households Approaching Retirement Have Low Savings (2015). This report to the Ranking Member,Subcommittee on Primary Health and Retirement Security, Committee on Health, Education, Labor, and Pensions, U.S. Senate, from the Government Accountability Office (GAO) paints a pretty dire picture.

The report observes that as baby boomers move into retirement each year, the Census Bureau projects that the age 65-and older population will grow over 50 percent between 2015 and 2030. Particular attention is paid to the fact that there is an ongoing shift in private-sector pension coverage from defined benefit plans (i.e. traditional pensions) to defined contribution plans such as 401(k)s. Not really a surprise there as anyone that has been paying attention to pay and benefits in the current business environment is aware of the shift.

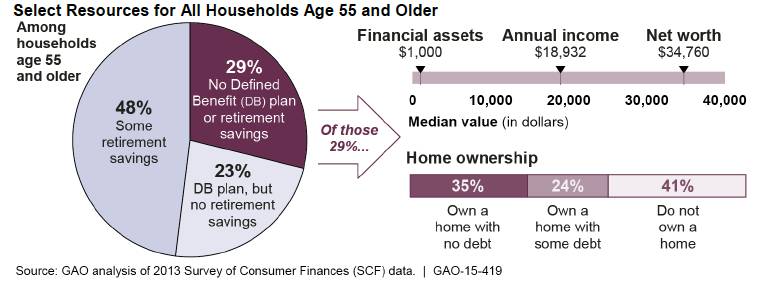

Taking two significant factors – longer life expectancies and uncertainty about Social Security’s long-term financial condition – into consideration, the report analyzes various studies and surveys from organizations such as the Federal Reserve Board and the Employee Benefit Research Institute to provide a review of how Americans are doing when it comes to retirement savings. Perhaps not surprisingly, the GAO concludes … not that well. The big headline is their analysis shows that among households with members aged 55 or older, nearly 29 percent have neither retirement savings nor a traditional pension plan. Yikes! As bad as that is, I actually would have thought that number was even higher, perhaps somewhere in the mid-30s.

Beyond those headline numbers there are a number of interesting facts shared in the text and illustrated in a number of graphs and tables. If you have an interest in getting a pretty detailed view of how Americans are saving – or not saving – for retirement, this report, available for download as a .pdf, is worth a look.